How To Reprint Tds Paid Challan 281

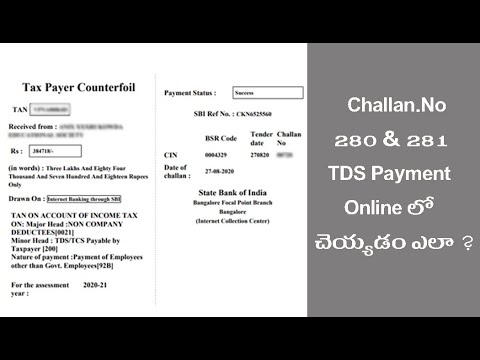

How to file salary tds return – form 24q Tds challan 281 How to pay tds challan 281 online through net banking in telugu

How To File Salary TDS Return – Form 24Q

Tds challan 281 excel format word Challan tax jagoinvestor paying interest reciept Challan tds 281 tcs itns

Tds challan income tax portal

Tds challan payment income tax portal |how to pay tds online |tdsTds challan 281: what is it and how to pay?- razorpayx Tds excel challan signnow pdffillerHow to check tds challan status online.

Tds challan april and may 1906How to fill challan for tds deposit (challan 281) हिन्दी मे How to fill tds or tcs challan / download tds/tcs challan 281Challan tds tcs.

Tds paid but challan not available on e filing portal of income tax

Pay tds online: how to make tax payment easily (2022 update)How to download tds paid challan pdf from efiling income tax portal How to reprint tds challan 281! how can i reprint tds paid challan! howTds challan 281 excel format fill out and sign printa.

Pay tds online: how to make tax payment easily (2022 update)Challan tds Income tax challan 281 in excel formatChallan tds deposit vary subject.

Online tds payment challan 281

How to download tds challan 281 and 280 from income tax site as well asTds payment process online on tin-nsdl Tds tax challan deptTds challan 281 excel format fill out and sign printa.

Tds paid challan receipt download / article / vibrantfinservE-pay tax : income tax, tds through income tax portal How to generate a new tds challan for payment of interest and lateHow to reprint income tax challan after payment| how to download income.

How to pay tds online, tds challan form 281 ii how to calculate

In & out of e-tds challan 280, 281,282, 26qb – i. tax dept.|Tds online payment, income tax challan 281 online, traces login at How to pay income tax online : credit card payment is recommended toTds/tcs tax challan no./itns 281.

Tds challan itns 281- pay tds online with e- payment taxIncome tax challan 280 fillable form Tds-challan-281-word-format.doc.

TDS Challan 281 - Pay Online TDS with E Payment Tax | Razorpay Payroll

How to Pay TDS Challan 281 online through Net Banking in Telugu - YouTube

How To File Salary TDS Return – Form 24Q

How To Pay Income Tax Online : Credit card payment is recommended to

How to pay TDS online, Tds Challan form 281 II How to calculate

TDS/TCS Tax Challan No./ITNS 281

TDS Challan Income Tax Portal | E Pay Tax | Tds Challan form 281 | Tds

TDS paid challan receipt download / Article / VibrantFinserv